Optimize Your Portfolio

Enhance your Institution’s Financial Health with MountainSeed Loan Sale Advisory

We specialize in valuing and/or purchasing distressed and performing loans, providing capital relief, enhanced liquidity, and reduced CRE risk exposure. Trust us to advise you in optimizing your CRE loan portfolio. MountainSeed brings 20+ years of experience in loan production, problem loan workouts, and loan sales/purchased.

Optimize Your Portfolio

Enhance your Institution’s Financial Health with MountainSeed Loan Sale Advisory

We specialize in valuing and/or purchasing distressed and performing loans, providing capital relief, enhanced liquidity, and reduced CRE risk exposure. Trust us to advise you in optimizing your CRE loan portfolio. MountainSeed brings 20+ years of experience in loan production, problem loan workouts, and loan sales/purchased.

A Decade of Trust and Expertise

MountainSeed was founded in 2010 and assisted in the acquisition of 100+ failed financial institutions during the Great Financial Crisis.

As there is interest rate volatility, MountainSeed positions itself to help clients weather the storm.

Take a closer look:

$100B of CRE transactions are seen by our firm annually through our due-diligence related services.

MountainSeed recently facilitated a $25MM loan transaction

between a $12.5B bank in Tennesee and a $3.5B bank in Kentucky.

Shore Up Your Balance Sheet With

MountainSeed Loan Sale Advisory

Liquidity Enhancement

Risk Mitigation

Reduce your general CRE risk and credit risk exposure. Distressed loan sales are currently strong, but prices may decline as more loans become distressed. For performing loans, like participations and B-Notes, this reduces individual loan exposure and risk-based capital while retaining servicing.

Efficiency Optimization

Partnering with MountainSeed allows you to streamline your operations, redirecting valuable resources & personnel towards your core banking activities, ultimately improving efficiency and profitability.

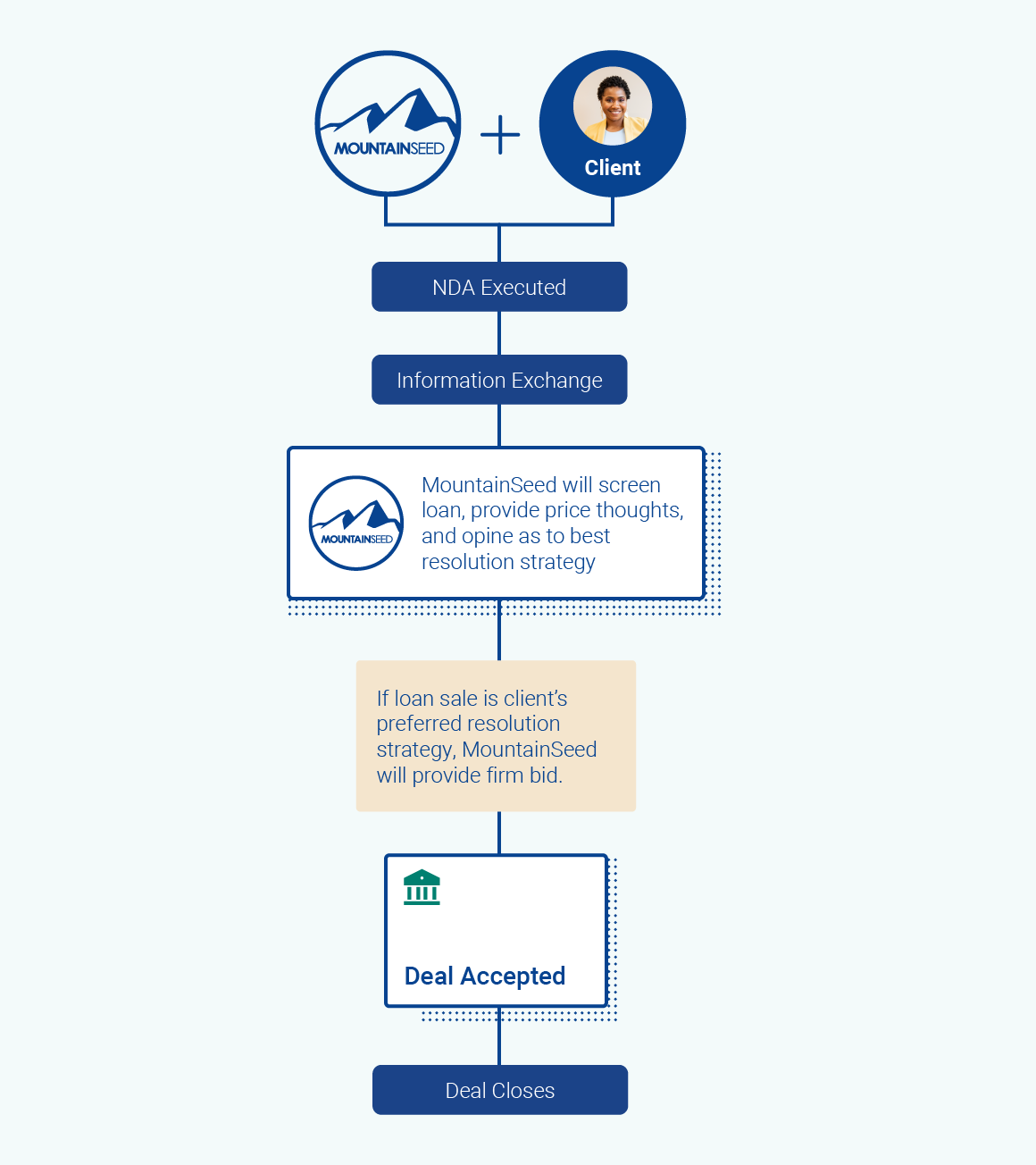

The Loan Sale Process Breakdown

Loan Sale Advisory in a Few Simple Steps

MS and Loan Seller (“Client”) have a high-level discussion of the CRE loan sale market and determine if there are loans that the Client would consider disposing. MS has an appetite for all property types, including office.

Other Services

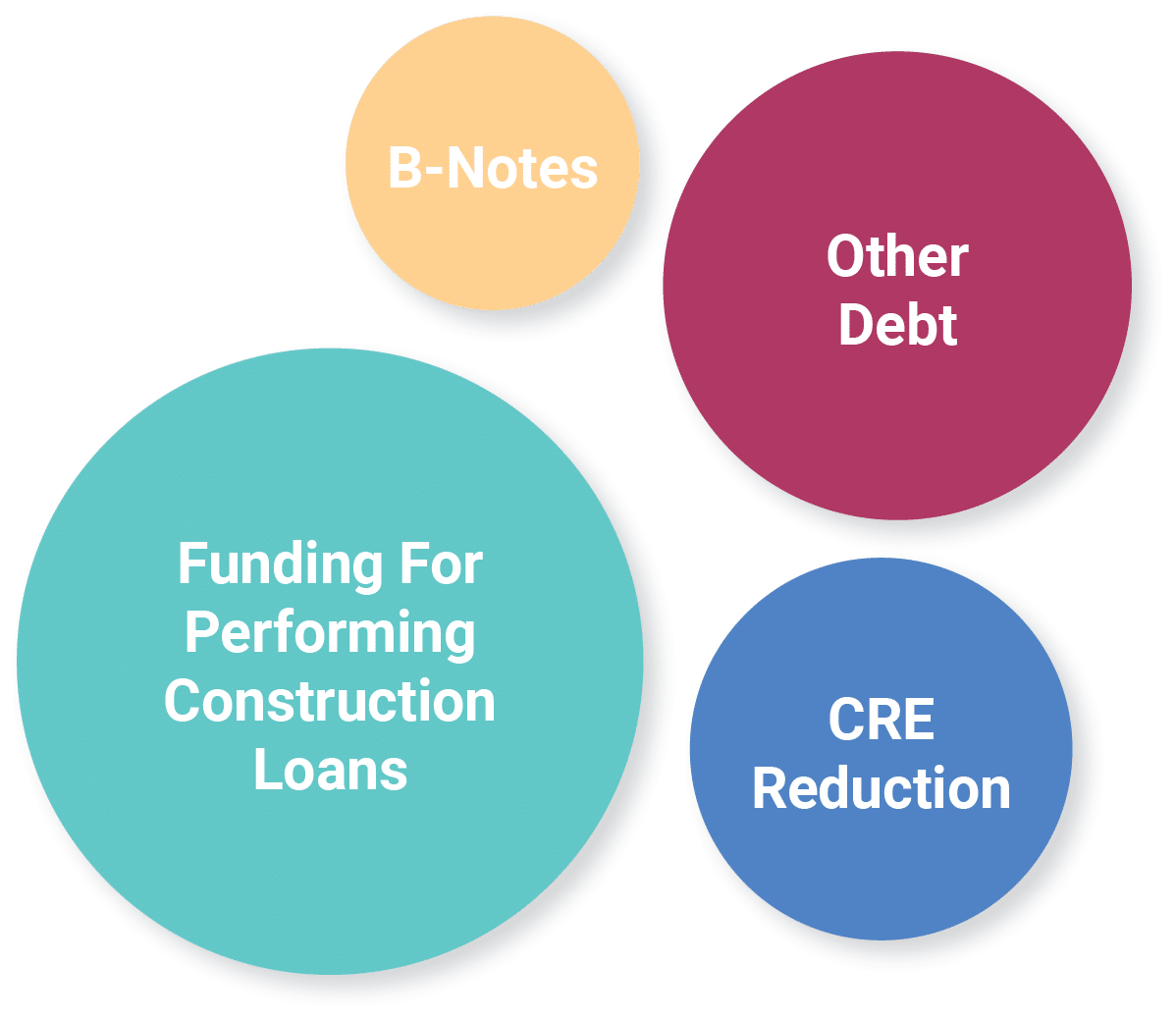

- MS has been working with Clients to purchase B-Notes on new CRE loan originations. This will lower LTVs for Clients and allow the Client to capture additional business and further Borrower relationships.

- MS has been exploring options for Clients to reduce CRE exposure and risk on its existing portfolio through participations, B-Notes, and loan-on-loan financing, while minimizing realized losses to the Client.

- MS will also look at other debt such as loans secured by farms, churches, ships, equipment, and other unique collateral.

By submitting this form, you agree to be contacted by email, phone, or text message by MountainSeed at the provided contact information for promotional and administrative purposes. You are not obligated to agree to this contact; instead, you may contact us directly at (855) 640-0905. Reply STOP to opt out from text messages. Message and data rates may apply. Message frequency varies. For more information, please see our Privacy Policy.

Connect With Us

Together We Climb

We recognized that there is a better way to approach commercial real estate and lending, and out of that, MountainSeed was born.

- Zero Budget impact. We guarantee that your Financial Institution will never lose a loan based upon our fee.

- Offering a one-stop Marketplace for lenders from collateral to due diligence in one platform.

- The most accurate, relevant, current data for commercial real estate lenders.