Unlock Your Bank’s Hidden Capital

Maximize Your Bank’s Assets

with a Sales-Leaseback Strategy

Discover how a sale-leaseback strategy can unlock the hidden potential of your real estate assets. Convert depreciated properties into significant financial gains and use these funds to boost capital, pay down loans, or offset losses.

Transform Your Real Estate Assets

with Sale-Leaseback Strategies

Unlock Appreciated Value

Convert your property’s appreciated value into liquid assets turning dormant real estate into active capital, ready for immediate use.

Improve Capital Ratios

By converting fixed assets into cash, you can significantly improve your capital ratios enhancing your financial standing.

Increase Financial Flexibility

A Decade of Trust and Expertise

For the past 10 years, MountainSeed has served

more than 10% of the banks and credit unions in America.

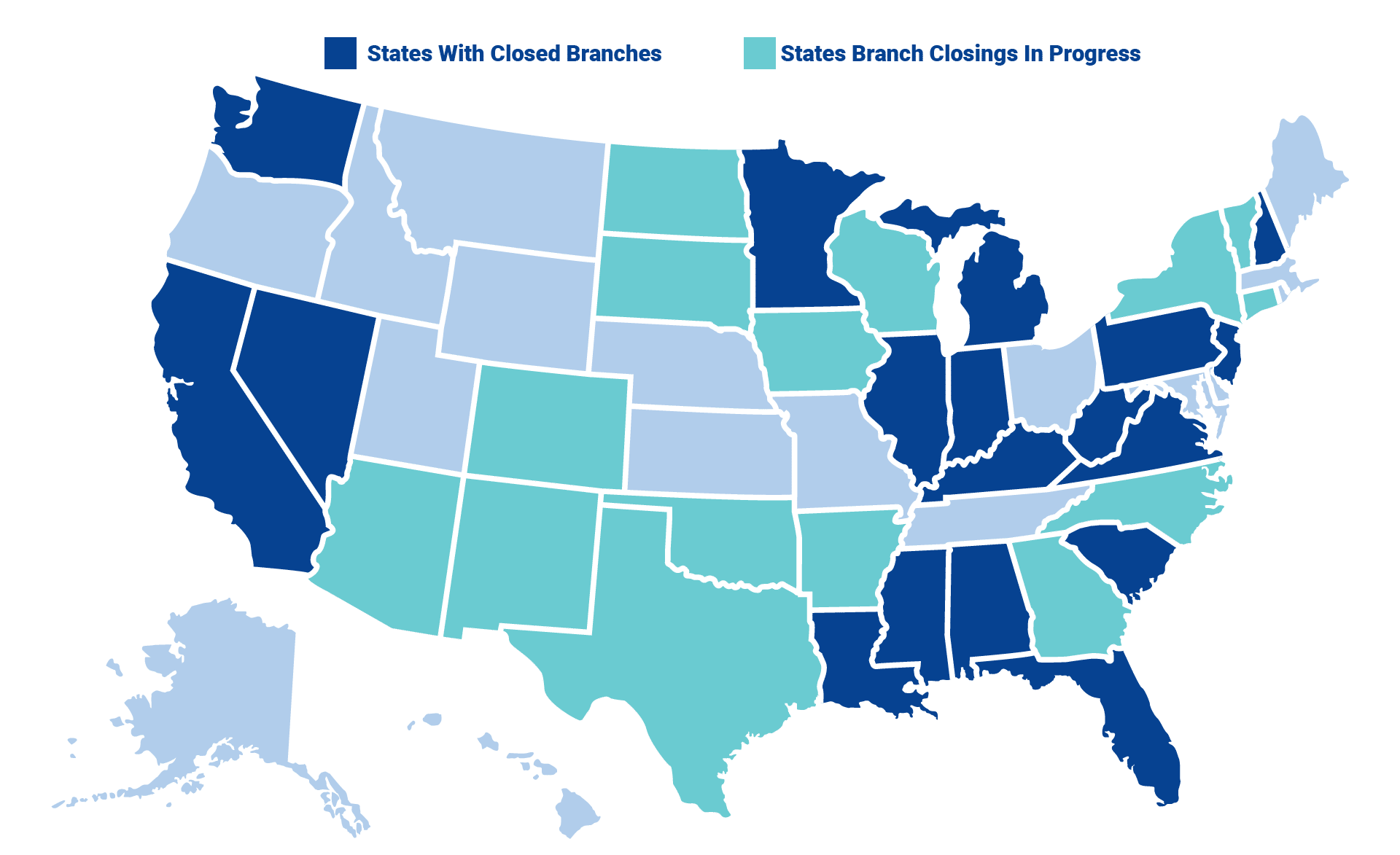

Recent Sampling of Branch Closings

Sale-leaseback Process

Transform Your Property Into Capital for Growth and Stability

MountainSeed’s Sale-leaseback Program presents a strategic opportunity for businesses seeking financial agility and asset optimization. This 90-day process not only offers a swift path to liquidity but also customizes transaction terms to align with your long-term financial goals and operational needs. Partnering with MountainSeed means navigating this complex transaction with ease, guided by expertise and a commitment to maximizing your property’s value and your business’s potential.

Step 1

Introduction Call

- Objective: Introduce Sale Leaseback Program

- Key Activities:

- Introduction to MountainSeed’s team and process

- Overview of the sale leaseback process and benefits.

- Initial assessment of the client’s property and financial goals.

- Deliverables: Meeting summary and set up next meeting to go over LOI with Patrick Roberts at MountainSeed set up next meeting to review LOI

Step 2

Branch Analysis

- Objective: In-depth evaluation of the client’s property portfolio.

- Key Activities:

- Collection of property data (location, size, book value).

- Market analysis and valuation of each branch.

- Deliverables: LOI outlining price and terms of the potential transaction

Step 3

Letter of Intent (LOI)

- Objective: Formalize intent to proceed with the sale leaseback transaction.

- Key Activities:

- Present LOI based on agreed terms from the branch analysis.

- Review and negotiation of LOI terms between MountainSeed and the client.

- Deliverables: Signed LOI, outlining key terms such as sale price, lease terms, and conditions.

- Next Steps: Determine steps to move forward (ie. internal bank approval, schedule and expectations on closing timeframe)

Step 4

Due Diligence

- Objective: Thorough examination of all aspects of the proposed transaction.

- Key Activities:

- Legal and financial due diligence to verify property titles, leases, and Survey, counterparty financial review

- Physical inspection of properties to assess condition

- Finalization of Purcahse and sale agreement, lease agreements and transaction details.

- Deliverables: Purchase agreement, Master Lease

Step 5

Closing

- Objective: Completion of the sale leaseback transaction.

- Key Activities:

- Preparation of closing documents and final transaction details.

- Coordination of closing meeting with all parties involved.

- Execution of sale and leaseback agreements.

- Transfer of funds and property titles.

- Public announcement

- Deliverables: Closed transaction, transferred property ownership, and initiated leaseback agreement.

Helping Banks Across the U.S

Unlocking Potential For Our Customers

By submitting this form, you agree to be contacted by email, phone, or text message by MountainSeed at the provided contact information for promotional and administrative purposes. You are not obligated to agree to this contact; instead, you may contact us directly at (855) 640-0905. Reply STOP to opt out from text messages. Message and data rates may apply. Message frequency varies. For more information, please see our Privacy Policy.

Connect With Us

Together We Climb

We recognized that there is a better way to approach commercial real estate and lending, and out of that, MountainSeed was born.

- Zero Budget impact. We guarantee that your Financial Institution will never lose a loan based upon our fee.

- Offering a one-stop Marketplace for lenders from collateral to due diligence in one platform.

- The most accurate, relevant, current data for commercial real estate lenders.