Thought Leadership

Stay Up-to-Date on the Latest Industry News, Events, & Trends

MountainSeed and First State Bank Complete Sale Leaseback Deal

Atlanta, GA and Gainesville, TX – June 30th, 2025 – MountainSeed Real Estate Services, LLC (“MountainSeed”), a Georgia...

MountainSeed and Seasons Federal Credit Union Finalize Sale Leaseback Deal

Atlanta, GA and Middletown, CT – March 26, 2025. MountainSeed Real Estate Services, LLC ("MountainSeed"), a Georgia...

MountainSeed and Shoreline Credit Union Complete $4.8mm Sale Leaseback Transaction

Atlanta, GA and Two Rivers, WI – February 21, 2025. MountainSeed Real Estate Services, LLC ("MountainSeed"), a Georgia...

MountainSeed and Harborstone Credit Union Complete $42mm Sale Leaseback Transaction

ATLANTA, GA, UNITED STATES, February 20, 2025 -- MountainSeed Real Estate Services, LLC ("MountainSeed"), a Georgia...

Maximizing Capital Efficiency: The Rise of Sale-Leaseback Transactions in Banking

Maximizing Capital Efficiency: The Rise of Sale-Leaseback Transactions in Banking In 2024, MountainSeed witnessed a...

MountainSeed Facilitates Two Major Transactions, Showcasing Its Market Expertise

[Atlanta, GA] – [January 13, 2025] – MountainSeed, a leading partner in real estate and financial services, is proud...

MountainSeed Celebrates Successful December with Approximately $80 Million in Bank Branch Acquisitions

[Atlanta, GA] – [January 6, 2025] – MountainSeed, a leader in real estate and financial services, proudly announces...

MountainSeed Real Estate Services, LLC Completes Sale-Leaseback Transaction with Insight Credit Union

Atlanta, GA and Winter Springs, FL – November 12, 2024. MountainSeed Real Estate Services, LLC ("MountainSeed"), a...

MountainSeed Real Estate Services, LLC Completes Sale-Leaseback Transaction with 1st Federal Savings Bank of SC, Inc.

Atlanta, GA and Walterboro, SC – September 6, 2024. MountainSeed Real Estate Services, LLC ("MountainSeed"), a Georgia...

Navigating the Future of Interest Rates

MountainSeed Real Estate Services, LLC Completes Sale-Leaseback Transaction with CIB Marine Bancshares, Inc.

Atlanta, GA and Champaign, IL – July 24, 2024. MountainSeed Real Estate Services, LLC ("MountainSeed"), a Georgia...

MountainSeed Real Estate Services, LLC Completes Sale-Leaseback Transaction with First Bank of Alabama

Atlanta, GA and Talladega, AL – July 17, 2024. MountainSeed Real Estate Services, LLC ("MountainSeed"), a Georgia...

First Seacoast Bank Completes Sale-Leaseback Transaction with MountainSeed Real Estate Services, LLC

Dover, NH, and Atlanta, GA – June 17, 2024. Effective June 11, 2024, First Seacoast Bank, the wholly-owned subsidiary...

MountainSeed Secures $2 Billion Commitment to Acquire Bank Branches, Bolstering Support for Community Banks and Credit Unions

Atlanta, GA — [May 20, 2024] — MountainSeed Real Estate Services, LLC ("MountainSeed") is proud to announce the...

MountainSeed & First Fed Bank Complete $14.7 million Sale-Leaseback Deal

On May 7, 2024, First Fed Bank, a Washington-chartered commercial bank ("First Fed") and wholly owned subsidiary of...

MountainSeed and Finward Bancorp Complete $17.2 million Sale-Leaseback Transaction

Finward Bancorp (Nasdaq: FNWD), the holding company for Peoples Bank (the “Bank”), and MountainSeed Real Estate...

MountainSeed Real Estate Services, LLC Completes Sale Leaseback Transaction with Plumas Bancorp

RENO, Nev., Feb. 15, 2024 (GLOBE NEWSWIRE) -- Plumas Bancorp (Nasdaq: PLBC), the parent company of Plumas Bank, and...

MountainSeed & The Citizens Bank Forge Strategic Partnership through Sale-Leaseback Deal

In this transformational deal, MountainSeed will acquire three key branches from The Citizens Bank and lease them back...

7 Steps of the Commercial Appraisal Process

While commercial appraisals are an integral part of estimating the market value of a property, the appraisal process...

The ABCs of Understanding the Appraisal Process

While it might seem complicated, understanding the appraisal process is simpler than you think. It’s as easy as...

Process or Checklist: The Nitty Gritty of an Appraisal Review

In the past, banks primarily focused on the appraisal, however, the appraisal review has become more significant in...

50 Appraisal Management Terms You Need to Know

When it comes to appraisal management and appraisal management companies, there are tons of terms you should know....

What are Appraisal Review Services and When are They Needed?

Over the years, the appraisal review has become an essential part of the appraisal process. While the review is...

When to Use an Abundance of Caution Exemption and Why

Does your loan applicant qualify for an extension of credit based on a strong cash flow or collateral that is not real...

Why Does Your Regulator Want You to Know the Difference Between Leased Fee and Fee Simple?

Appraisal clients often ask the question about the difference between Leased Fee and Fee Simple interests. Not only should they be differentiated, but these two terms are ones that your regulator cares about.

Understanding Different Appraiser Licenses

When it comes to determining the market value of your residential or commercial property, bringing in a licensed appraiser is a given. But did you know there are many different types of appraiser licenses? Here’s what you need to know about the various levels of certification and what’s required to become a professional real property appraiser.

Getting a Second Opinion: Why, How, & When You Should Get a Second Appraisal

As parties to a mortgage transaction contingent upon an appraisal, borrowers and lenders often struggle with a dilemma when they are unhappy with the results of appraisal.

How Portfolio Analytics can Help Community Banks Prepare for Stress Testing

Every community bank understands the importance of stress testing and how these results can help determine portfolio risks. Banks can use stress tests to assess potential concentrations in commercial real estate (CRE) lending.

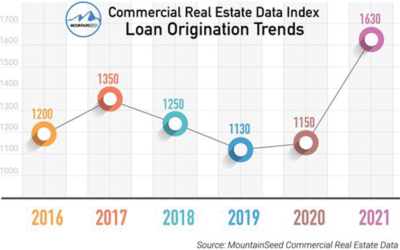

Community Banks Set to Break Loan Origination Records

Commercial Loan originations are set to hit record levels among community banks, according to recent data from the MountainSeed Analytics Commercial Real Estate Data Index (CREDI).

Connect With Us

Together We Climb

We recognized that there is a better way to approach commercial real estate and lending, and out of that, MountainSeed was born.

- Zero Budget impact. We guarantee that your Financial Institution will never lose a loan based upon our fee.

- Offering a one-stop Marketplace for lenders from collateral to due diligence in one platform.

- The most accurate, relevant, real-time data for commercial real estate lenders.