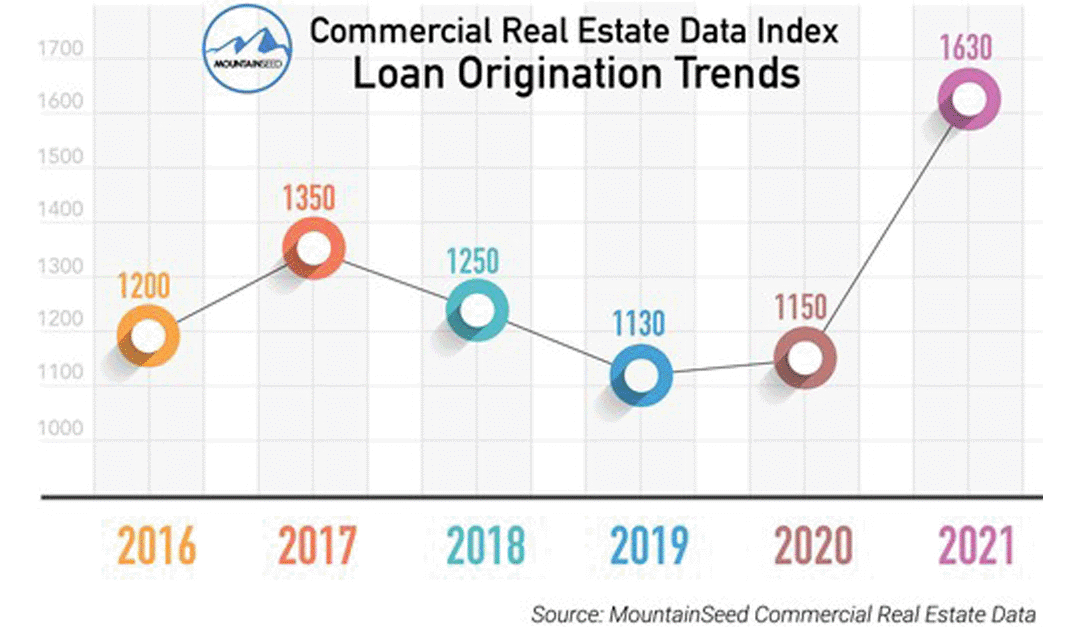

Commercial Loan originations are set to hit record levels among community banks, according to recent data from the MountainSeed Analytics Commercial Real Estate Data Index (CREDI).

The Commercial Real Estate Data Index shows a dramatic increase in commercial real estate loan originations in the first half of 2021 and a pace that should eclipse 2020 by 39% and also top 2019’s pre-COVID numbers by 30%. This index is compiled from the commercial real estate appraisal ordering trends of hundreds of community financial institutions.

“These numbers show that community and regional banks and credit unions remain competitive and optimistic about CRE in a post COVID environment,” said Carl Streck, MountainSeed’s CEO. “Because community lenders are close to the assets and their local markets, they can move faster and be more competitive than much larger lenders and the numbers show it.”

With the overall trajectory being strong there are still some asset classes where lenders remain hesitant. Retail and Office loan originations are projected to be slightly down year-over-year, while Hospitality lending is expected to increase 100% from its pandemic lows. This signals that lenders are confident in the return to tourism/travel, but still concerned about the longer term impact on office and retail space due to continued work from home and the impact of online shopping on future retail leases.

If you would like to learn more about MountainSeed Analytics or the Commercial Real Estate Data Index (CREDI) visit us at https://mountainseed.com/analytics/.